Master new skills,

faster

AI-curated learning paths, interactive tutorials, and job-ready certificates—built for focus and momentum.

AI-curated learning paths, interactive tutorials, and job-ready certificates—built for focus and momentum.

trust Tutorial Rocks for their daily AI learning

Personalized learning experiences with advanced AI that adapts to your pace, style, and goals. Get smarter recommendations as you learn.

Structured courses that guide you from beginner to expert.

Showcase your achievements with professional certificates.

Join 10k+ learners sharing knowledge worldwide.

Hands-on coding exercises and real-world projects.

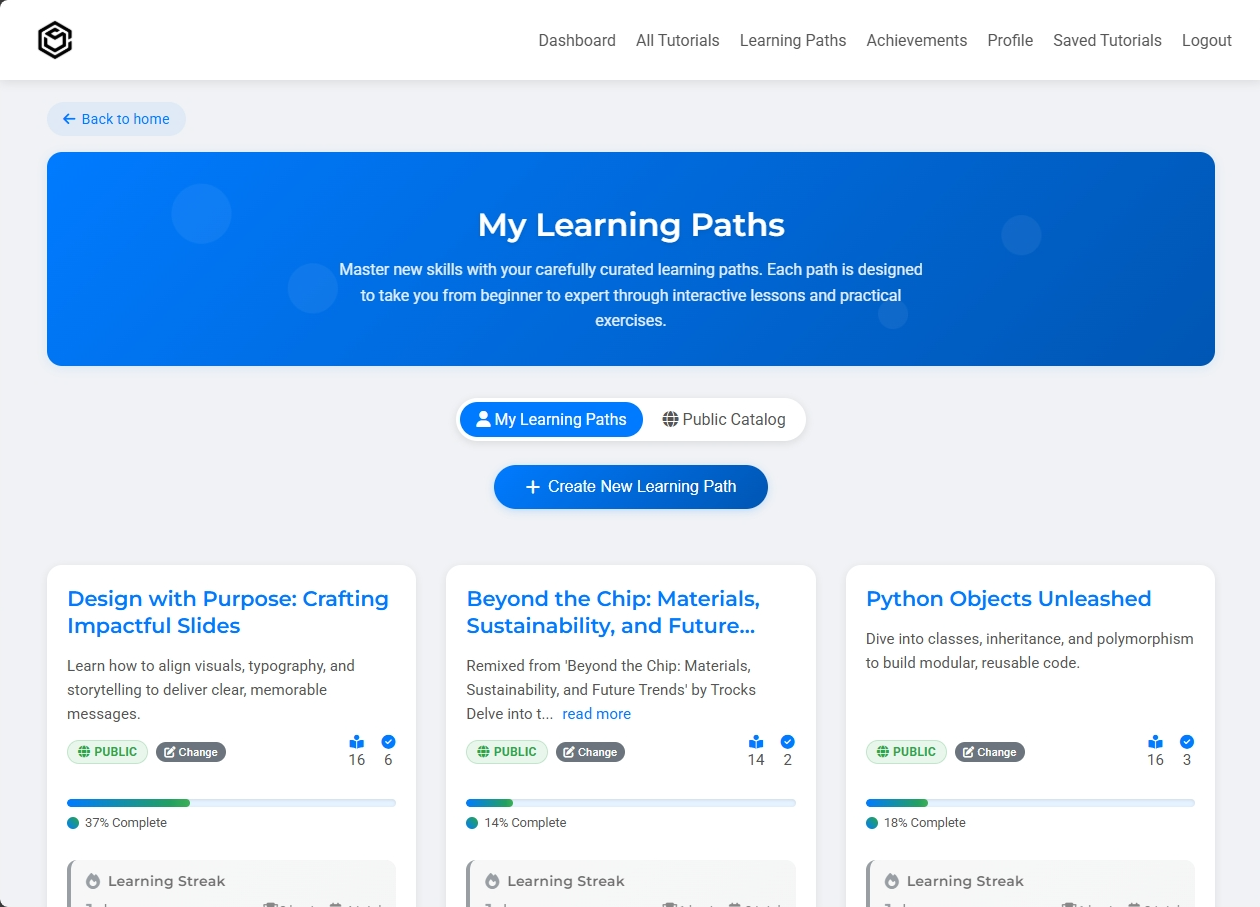

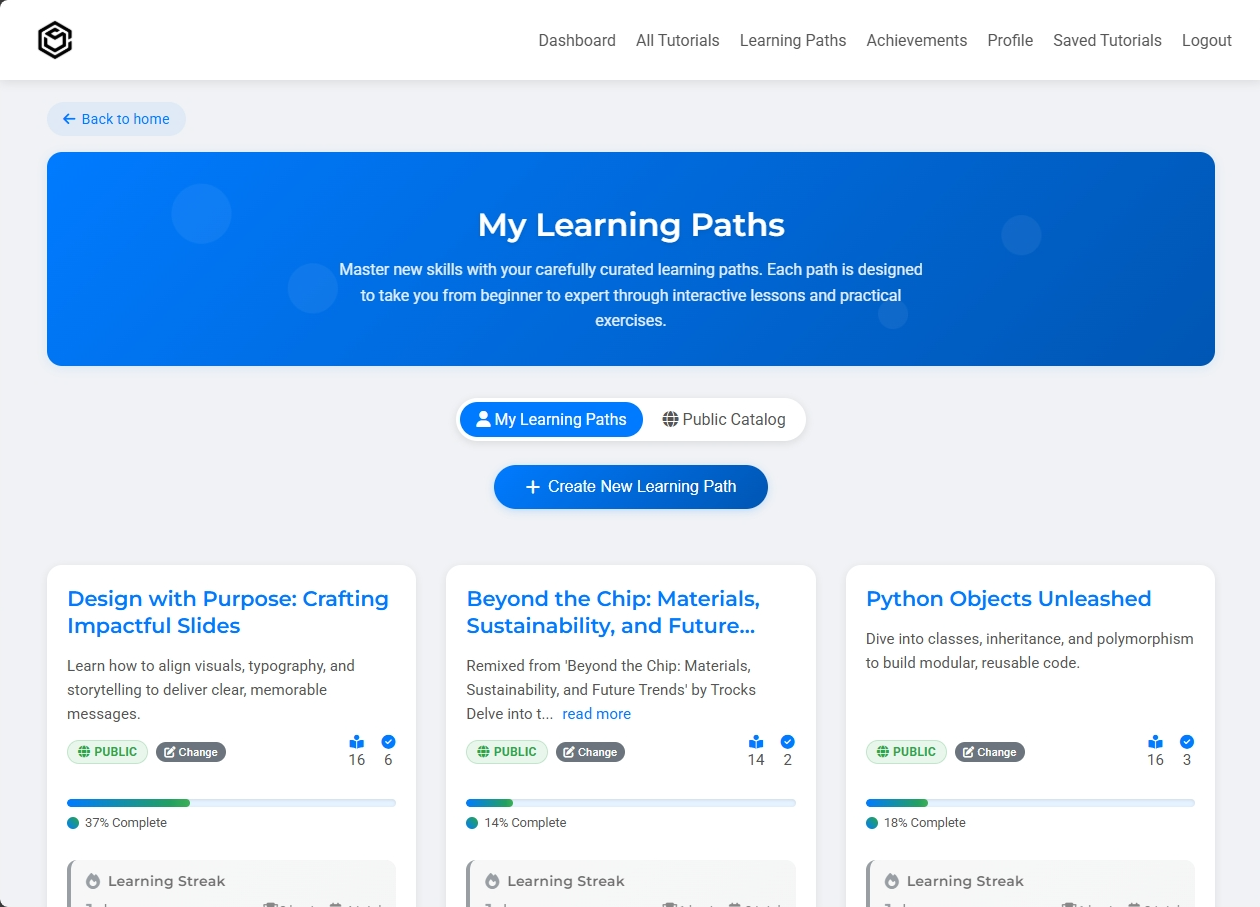

Your personalized journey to mastery. AI-powered curation meets structured learning.

Smart algorithms create personalized learning paths tailored to your goals and skill level

Visual progress bars and milestones keep you motivated throughout your learning journey

Complete learning paths and earn professional certificates to showcase your achievements

Customize existing paths or create your own, then share with the community

AI-powered search helps you find the perfect learning path from our community catalog

Access thousands of public learning paths created by experts and fellow learners

Join our community and build momentum with guided paths and interactive tutorials.